For decades, the memory chip industry has been infamous for its brutal boom-and-bust cycles. Periods of soaring demand and soaring profits were routinely followed by oversupply, collapsing prices, factory shutdowns, and layoffs. Companies making DRAM and NAND memory learned to expect volatility as a permanent feature of the business.

But according to memory chip makers and industry analysts, artificial intelligence is fundamentally changing that equation.

AI isn’t just another source of demand. It’s reshaping how memory is designed, purchased, priced, and planned—potentially smoothing the extreme cycles that once defined the sector.

This article expands on that idea, explains why AI demand is different from past tech waves, highlights what’s often overlooked, and explores whether the memory industry has truly entered a more stable era.

Why Memory Chips Have Always Been Cyclical

A History of Volatility

Memory chips—especially DRAM and NAND—are largely commoditized. One gigabyte of memory from one supplier is functionally similar to another’s. This has historically led to:

- Fierce price competition

- Overinvestment during good times

- Massive oversupply during downturns

- Sudden crashes in prices and profits

Even small miscalculations in demand could send the entire market swinging wildly.

Past Demand Was Bursty

Previous drivers of memory demand—PCs, smartphones, gaming consoles, consumer electronics—came in waves. Once those markets matured, demand flattened or declined, leaving manufacturers with too much capacity.

How AI Changes the Memory Equation

AI is different from previous demand cycles in several critical ways.

1. AI Requires Vast Amounts of Memory

Training and running AI models requires enormous memory capacity to handle:

- Large datasets

- Model parameters

- Real-time inference workloads

- Parallel processing across accelerators

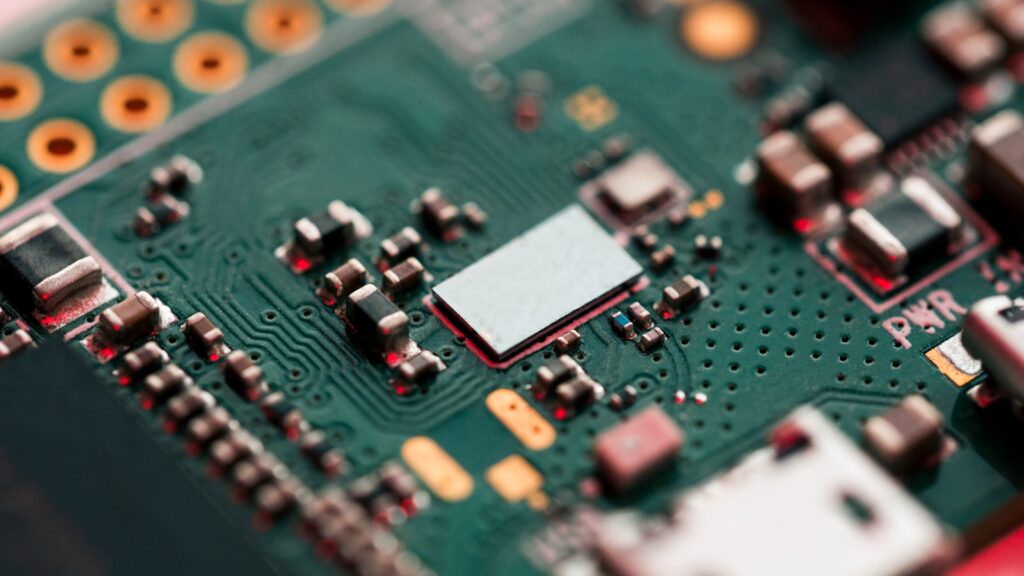

High-bandwidth memory (HBM), advanced DRAM, and fast NAND are now core infrastructure, not optional components.

2. AI Demand Is Structural, Not Cyclical

Unlike consumer electronics, AI adoption is happening across:

- Cloud data centers

- Enterprise software

- Healthcare, finance, manufacturing

- Government and defense

- Research and science

This creates persistent, multi-year demand rather than short product cycles.

3. Memory Is Becoming More Specialized

AI workloads require memory that is:

- Faster

- Closer to processors

- More power-efficient

- More tightly integrated with accelerators

This reduces commoditization. Specialized memory products command higher margins and are harder to oversupply quickly.

What Chip Makers Are Doing Differently Now

More Disciplined Capacity Expansion

After years of painful downturns, memory manufacturers are:

- Slowing factory expansion

- Aligning capacity more closely with long-term demand

- Avoiding aggressive price wars

This discipline is reinforced by the massive capital costs of new fabs.

Longer-Term Customer Contracts

AI customers—especially cloud providers—are signing longer-term supply agreements. This improves:

- Demand visibility

- Pricing stability

- Investment planning

Memory makers are no longer guessing blindly.

AI Is Helping Plan Production

Ironically, AI itself is helping memory manufacturers:

- Forecast demand more accurately

- Optimize yields

- Improve manufacturing efficiency

- Reduce waste

Better data reduces extreme swings.

What Often Gets Overlooked

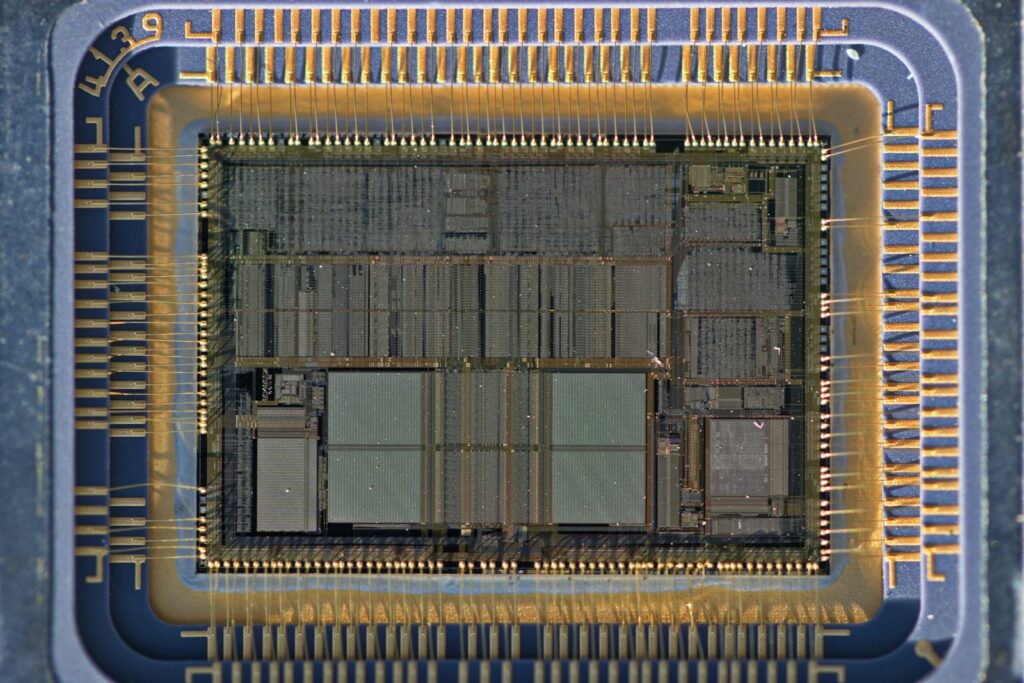

HBM Is a Game-Changer

High-bandwidth memory has become one of the most valuable components in AI systems. Supply is constrained, production is complex, and demand is strong. This has shifted pricing power toward manufacturers.

Geopolitics and Supply Chains Matter More

Governments now treat semiconductors as strategic assets. Export controls, subsidies, and national security considerations affect:

- Where fabs are built

- How capacity is allocated

- Which customers get priority

This reduces the likelihood of reckless global oversupply.

Capital Intensity Is a Natural Brake

Building advanced memory fabs costs tens of billions of dollars. That alone discourages the kind of unchecked expansion that fueled past busts.

Is the Boom-and-Bust Cycle Really Gone?

Not entirely—but it may be less extreme.

Memory markets will still fluctuate due to:

- Economic slowdowns

- Technology transitions

- Shifts in AI architectures

However, AI-driven demand is broader, deeper, and more persistent than past cycles. Combined with better discipline and planning, this suggests shallower downturns and longer upswings.

What This Means for the Tech Industry

For Chip Makers

- More predictable revenue

- Higher margins for specialized memory

- Stronger bargaining power with customers

For AI Companies

- Memory availability becomes a strategic constraint

- Long-term supply relationships matter more

- Costs may remain higher than in past cycles

For Investors

- Memory companies may look less like volatile trading vehicles and more like long-term infrastructure plays

What the Future of Memory Looks Like in the AI Era

Looking ahead, expect:

- Continued growth in HBM and AI-optimized memory

- Deeper integration of memory and compute

- Greater collaboration between chip designers and cloud providers

- Fewer—but more severe—supply bottlenecks

Memory is no longer just a component. It’s becoming a strategic pillar of AI infrastructure.

Frequently Asked Questions (FAQ)

Why does AI use so much memory?

AI models process massive datasets and require fast access to parameters during training and inference, making memory bandwidth and capacity critical.

Does this mean memory prices won’t crash anymore?

Prices can still fall, but extreme crashes caused by massive oversupply are less likely due to disciplined expansion and persistent AI demand.

What is high-bandwidth memory (HBM)?

HBM is a type of advanced memory stacked close to processors, offering much higher speed and efficiency—essential for AI accelerators.

Are memory chips still commoditized?

Basic memory remains somewhat commoditized, but AI-focused memory products are more specialized and differentiated.

Could another bust still happen?

Yes—but it would likely require a major AI slowdown or technological shift. Even then, the downturn may be less severe than in the past.

Final Thoughts

Artificial intelligence is doing more than driving demand for memory chips—it’s reshaping the entire economic model of the industry.

By creating sustained, high-value demand and forcing greater discipline in production, AI may finally tame the memory sector’s legendary volatility. The boom-and-bust cycle may not disappear—but for the first time in decades, it looks fundamentally altered.

In the AI era, memory isn’t just along for the ride.

It’s helping steer the future of computing itself.

Sources Bloomberg