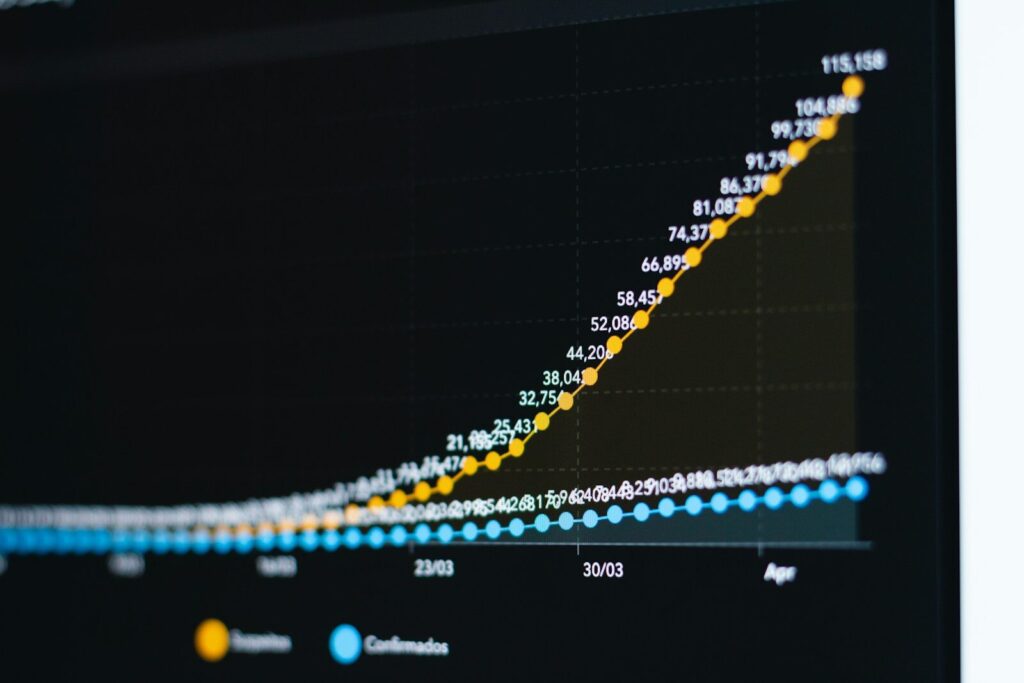

The world’s largest technology companies — often called hyperscalers — are ramping up capital expenditures at historic levels to fuel the artificial intelligence boom. Billions are flowing into data centers, AI chips, networking gear, and power infrastructure. The spending is so large that it is reshaping not only the tech sector, but also energy markets, semiconductor supply chains, and even regional economies.

But is this surge sustainable? And what happens if AI demand doesn’t grow as fast as expected?

This article expands on recent reporting to explore why hyperscalers are spending so aggressively, where the money is going, what risks are emerging, and how this wave of AI capex could reshape global markets.

Why Hyperscalers Are Spending at Record Levels

Hyperscalers — companies like Amazon, Microsoft, Google, and Meta — operate massive cloud computing platforms. AI workloads have dramatically increased demand for:

- High-performance GPUs and accelerators

- Advanced data center facilities

- Specialized cooling systems

- High-speed networking infrastructure

AI models require enormous computing power not just to train, but to operate continuously for millions of users.

The result: capital expenditures are surging to meet demand — and to outpace competitors.

Where the Money Is Going

1. AI Chips and Accelerators

The most visible spending category is advanced semiconductors.

AI workloads depend heavily on:

- GPUs

- Custom AI accelerators

- High-bandwidth memory

- Interconnect technology

Demand has outstripped supply, pushing hyperscalers to secure long-term chip contracts and even develop proprietary silicon.

2. Data Center Expansion

AI requires specialized data centers equipped with:

- High-density server racks

- Liquid or advanced air cooling

- Backup power systems

- Fiber connectivity

These facilities take years to build and require billions in upfront investment.

3. Energy Infrastructure

AI’s electricity needs are staggering.

Hyperscalers are:

- Investing in renewable energy projects

- Securing long-term power purchase agreements

- Exploring nuclear and alternative energy partnerships

Energy has become a strategic priority alongside computing hardware.

4. Custom Silicon Development

To reduce reliance on external suppliers and lower long-term costs, hyperscalers are designing their own AI chips.

This vertical integration aims to:

- Optimize performance for specific workloads

- Improve margins

- Mitigate supply chain risk

The Competitive Pressure Behind the Spending

AI has become a winner-take-most market.

Hyperscalers fear:

- Losing enterprise customers

- Falling behind in model performance

- Ceding platform dominance

Capital expenditure is both defensive and offensive — ensuring scale today while positioning for tomorrow.

What’s Often Overlooked

AI Capex Is a Long-Term Bet

Data centers and energy contracts are not short-term investments. Hyperscalers are betting that AI demand will:

- Continue rising

- Expand into new industries

- Become foundational infrastructure

If demand slows, these assets could become expensive liabilities.

The Ripple Effects Extend Beyond Tech

AI capex impacts:

- Semiconductor manufacturers

- Construction and engineering firms

- Utilities and power grids

- Regional job markets

Some cities are experiencing rapid economic shifts as AI facilities move in.

Environmental Trade-Offs

Despite renewable investments, AI data centers:

- Consume vast energy

- Use significant water for cooling

- Strain local grids

Balancing AI growth with sustainability remains a major challenge.

Risks of Overinvestment

1. Demand Mismatch

If enterprise AI adoption slows or monetization disappoints, hyperscalers may face:

- Underutilized capacity

- Margin pressure

- Investor skepticism

2. Chip Supply Volatility

Dependence on a limited number of advanced semiconductor manufacturers creates geopolitical and logistical risk.

3. Capital Intensity and Returns

Massive upfront spending requires confidence in long-term revenue growth. If AI margins compress due to competition, returns may suffer.

Why Investors Are Watching Closely

Wall Street is evaluating:

- Revenue growth tied to AI services

- Margin sustainability

- Cost discipline

- Long-term demand signals

Investors support heavy spending — as long as it produces measurable returns.

The Bigger Picture: AI as Infrastructure

AI is increasingly treated like:

- Electricity

- Telecommunications

- Cloud computing

Foundational systems require massive upfront investment before profits stabilize.

Hyperscalers are positioning themselves as the backbone of this new infrastructure layer.

Frequently Asked Questions

Why are hyperscalers spending so much on AI?

Because AI workloads require specialized hardware, data centers, and energy, and companies want to maintain competitive advantage.

Is this spending sustainable?

It depends on continued AI demand growth and the ability to monetize services effectively.

What happens if AI demand slows?

Companies may face excess capacity and margin pressure, though long-term infrastructure investments may still hold value.

How does this affect consumers?

AI-powered services may become more integrated into everyday apps and cloud tools, potentially raising subscription costs.

Is AI capex creating a bubble?

It reflects high expectations. Whether it becomes a bubble depends on whether revenue growth matches infrastructure expansion.

Final Thoughts

The hyperscaler AI spending boom is one of the largest infrastructure expansions in tech history.

It reflects confidence that AI is not a passing trend, but a foundational shift in computing. Yet it also carries risk: massive capital commitments assume that AI demand will justify the cost.

For now, hyperscalers are building at full speed.

The question isn’t whether AI will shape the future.

It’s whether the future will generate enough value to justify the billions being poured into it today.

Sources CNBC