Daily market roundups often read like noise — stocks up, stocks down, earnings beats, guidance misses. But beneath the surface of the tech, media, and telecom (TMT) sector lies a clearer story about where the industry is heading in 2026 and beyond.

Recent market movements highlight an ecosystem under pressure to balance AI investment, slowing growth in legacy businesses, rising infrastructure costs, and shifting consumer behavior. While individual stock reactions may seem fragmented, the underlying trends are increasingly consistent.

Understanding those trends matters more than tracking any single ticker.

The Big Picture: A Sector in Transition, Not Crisis

The TMT sector is no longer defined by rapid, uniform growth. Instead, it’s splitting into distinct lanes:

- AI and infrastructure leaders continue to attract capital

- Legacy media and telecom firms face margin pressure

- Platform companies are being judged on execution, not vision

- Investors are rewarding discipline over expansion

This isn’t a downturn — it’s a recalibration.

Technology: AI Spending Drives Winners and Losers

AI Is Still the Core Growth Engine

Market reactions show that companies with credible AI strategies continue to outperform. But enthusiasm is no longer automatic.

Investors now ask:

- Is AI revenue real or speculative?

- Are margins improving or shrinking?

- Does AI reduce costs or only increase spending?

Companies that can show AI-driven efficiency, not just ambition, are being rewarded.

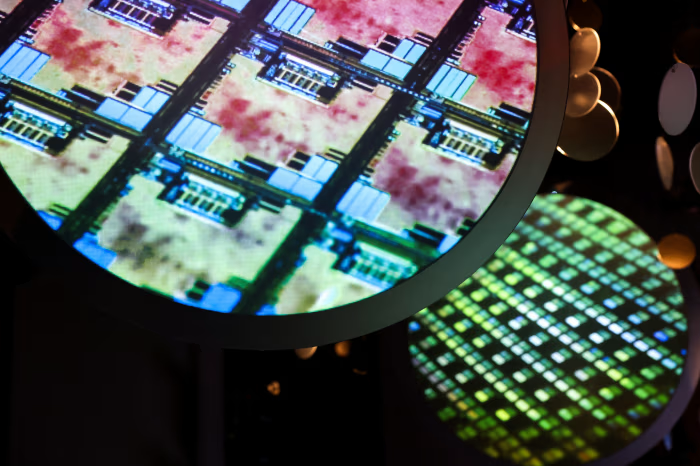

Hardware vs Software Divide

Chipmakers and infrastructure providers benefit from AI demand, while some software firms face skepticism if AI features don’t translate into pricing power.

The era of “AI buzz alone” moving stock prices is fading.

Media: Attention Is Scarce, and Ads Follow It

Streaming Reality Sets In

Media companies are facing the consequences of years of subscriber-first strategies.

Key pressures include:

- Rising content costs

- Slower subscriber growth

- Advertising volatility

Markets now favor:

- Profitable streaming models

- Bundling and consolidation

- Disciplined content spending

Growth without profit is no longer persuasive.

Advertising Is Becoming More Data-Driven

Ad markets are increasingly shaped by AI targeting and performance metrics. Platforms that can demonstrate measurable returns are capturing a greater share of ad budgets.

Telecom: Infrastructure Without Glamour

Telecom stocks often underperform despite being essential.

Why?

- High capital expenditure

- Heavy regulation

- Slow pricing flexibility

Yet telecom remains critical to:

- AI deployment

- Cloud services

- Edge computing

- Autonomous systems

The market treats telecom as infrastructure — stable, but rarely exciting.

Investor Sentiment: Patience Over Promises

Across tech, media, and telecom, investors are showing a clear preference for:

- Cash flow

- Margin discipline

- Predictable guidance

- Scalable business models

Companies promising future dominance without near-term results are being punished more quickly than in past cycles.

What Market Volatility Is Really Reflecting

Short-term stock moves often reflect:

- Earnings surprises

- Guidance revisions

- Interest rate expectations

But the longer-term signal is consistent:

The market is no longer paying for possibility alone — it’s paying for proof.

The Role of Regulation and Policy

Regulatory pressure continues to shape the sector:

- Antitrust scrutiny for platforms

- Data privacy requirements

- Spectrum and infrastructure rules

- Content moderation debates

Markets are increasingly pricing regulation as a permanent constraint, not a temporary risk.

Why This Moment Feels Different From Past Cycles

Unlike previous tech booms:

- Growth is uneven

- Capital is more selective

- Infrastructure costs are higher

- Labor and energy constraints matter

This environment favors incumbents that adapt — not disruptors chasing scale at any cost.

What This Means for the Rest of 2026

Expect:

- Continued AI investment, but with tighter budgets

- More consolidation in media and telecom

- Slower but more sustainable growth

- Increased focus on efficiency and execution

The days of broad sector rallies are likely over. Stock performance will be company-specific, not trend-driven.

Frequently Asked Questions

Is the tech sector still a good investment?

Yes — but selectivity matters more than ever. Not all tech companies benefit equally from AI and digital growth.

Why do telecom stocks lag despite high demand?

Telecom is capital-intensive and heavily regulated, which limits upside even as demand grows.

Is media still a growth industry?

Yes, but growth is slower and profitability is the key metric now.

Are AI stocks overvalued?

Some may be. Markets are increasingly differentiating between real revenue and speculative promise.

What’s the biggest risk for TMT investors?

Overestimating how quickly AI and digital investments translate into sustainable profits.

What’s the biggest opportunity?

Companies that use AI to improve efficiency, not just expand ambition.

The Bottom Line

Today’s tech, media, and telecom market moves are not random.

They reflect an industry entering a more mature phase — one where execution matters more than vision, and where growth must justify its cost.

The winners of this cycle won’t be the loudest innovators.

They’ll be the companies that turn technology into durable, disciplined business models — even when the market stops cheering.

Sources The Wall Street Journal