A Reality Check for One of 2025’s Hottest Markets

After a scorching rally powered by artificial intelligence hype, Asia’s tech-heavy stock markets just hit a major speed bump—and investors are taking notice.

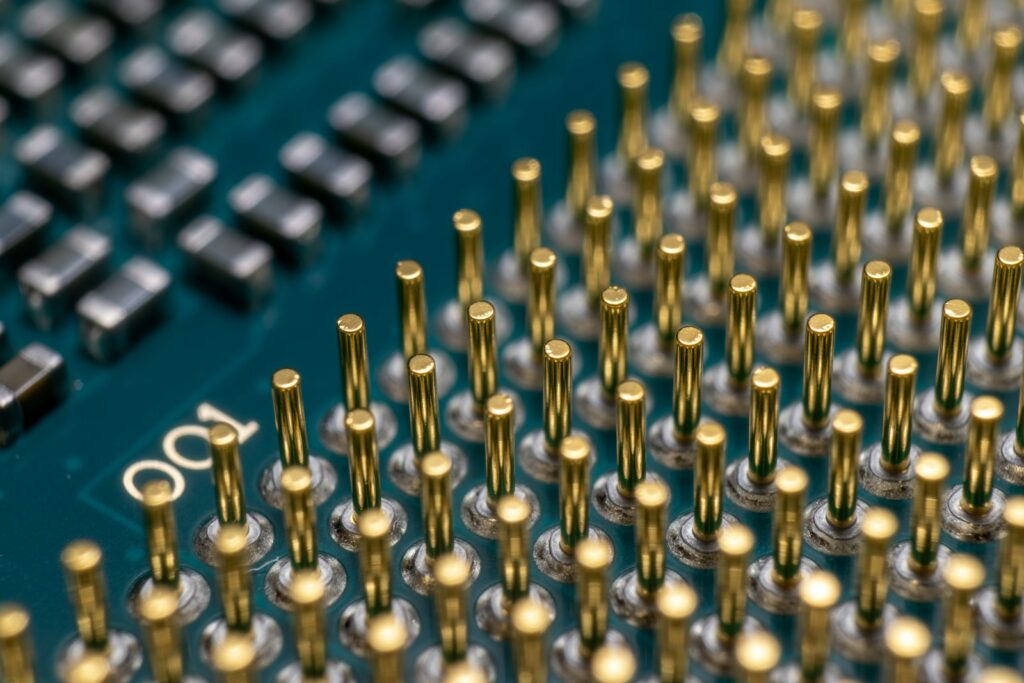

Markets across South Korea, Japan, Taiwan, and China saw a sharp sell-off, particularly among companies tied to AI chips, cloud infrastructure, and next-gen hardware. This correction has sparked big questions: Has the AI rally gone too far, too fast? Or is this just a healthy reset before the next leg up?

Let’s break it down.

🚨 What’s Behind the Sudden Sell-Off?

1. Valuations Got Too Hot to Handle

Many AI-linked companies surged in value without matching gains in revenue or profit. Investors are now asking: are these sky-high valuations really justified?

2. Profit-Taking After a Wild Run

Some of Asia’s most-hyped tech stocks were up 100%+ in 2025. That made them ripe for a pullback as traders locked in gains and rotated into safer plays.

3. Global Jitters Over Interest Rates and Demand

The U.S. Fed is still playing tug-of-war with inflation, and weakening demand for some tech hardware has investors second-guessing just how big AI demand will get in the near term.

4. Hype Fatigue

Let’s face it—AI promises are everywhere. But many firms are still figuring out how to actually make money from it. The market wants real results now.

5. Contagion Risk

Asia’s role in the AI supply chain—especially in semiconductors—means it’s highly exposed to global shifts. When Wall Street sneezes, Asia often catches a cold.

🔍 What the Headlines Missed

Here’s what didn’t make the splashy headlines—but matters big time:

- A Fragile Rally Built on Few Names: A handful of mega-cap AI stocks were doing all the heavy lifting in Asia’s markets. That’s never sustainable.

- Cash Flow Reality Check: Many of these companies are still burning cash. Investors are waking up to the gap between promise and profit.

- Asia’s Supply Chain Risk: With so many companies plugged into the global AI hardware pipeline, any slowdown hits the region first.

- Geopolitical Drag: U.S.-China tech tensions, export controls, and shifting alliances are clouding the long-term outlook for Asian AI players.

📉 Who’s Feeling the Pain?

- Chipmakers & Hardware Suppliers: These are on the frontlines of the AI buildout—and the first to get hit when demand softens.

- High-Growth, No-Profit Startups: Investors are turning cautious, especially with those that haven’t proven they can turn a profit.

- Export-Heavy Firms: Companies overly dependent on U.S. or EU demand are extra vulnerable to macro shocks.

💡 What Smart Investors Are Watching Now

- Earnings Quality: Is a company generating actual cash—or just making noise?

- AI Monetization Plans: Are we seeing real products and paying customers? Or just buzzwords?

- Diversification: Firms that can weather demand dips and geopolitical shifts are more likely to survive the hype cycle.

- Macro Signals: Interest rates, export restrictions, and global chip demand will shape what happens next.

🔁 Is This a Crash or a Reset?

It’s too early to call it a crash—but this looks like a much-needed reset. After months of pure hype, the market is demanding proof. That’s healthy.

Yes, AI is still the biggest tech trend of the decade. But the gold rush phase may be giving way to something more grounded: a demand for execution, earnings, and real-world value.

🧠 FAQs: What You Need to Know

Q1: Is the AI hype dead?

No. The narrative is still strong—but investors are done giving out free passes to unproven players.

Q2: Why are Asian markets hit harder than the U.S.?

Asia’s markets are more concentrated in hardware and global exports. When supply chains or demand slow, they feel it first.

Q3: Should I sell my AI stocks now?

If you’re in risky, unprofitable names—maybe. But long-term, high-quality players with real AI strategies are still strong bets.

Q4: What sectors are most exposed?

Semiconductors, cloud infrastructure, AI hardware, and export-reliant suppliers.

Q5: Could this turn into a bigger crash?

Not unless broader macro risks worsen. So far, this looks like a tech sector correction—not a total collapse.

🔚 Final Takeaway

Asia’s AI stocks aren’t dead—they just got a reality check. The party isn’t over, but the bouncers are now checking IDs at the door.

If you’re betting on the future of AI, bet smart. Look for real revenue, solid leadership, and the ability to adapt when the hype fades.

The next phase of the AI boom won’t be about who shouts the loudest—it’ll be about who delivers.

Sources Bloomberg