The artificial-intelligence boom has entered a new gear. Chipmakers, cloud-giants and tech investors are riding what looks like a tidal wave of enthusiasm. Yet, even as stock prices soar, many market participants remain uneasy. What’s powering the excitement, and why do the jitters persist?

What’s fueling the surge

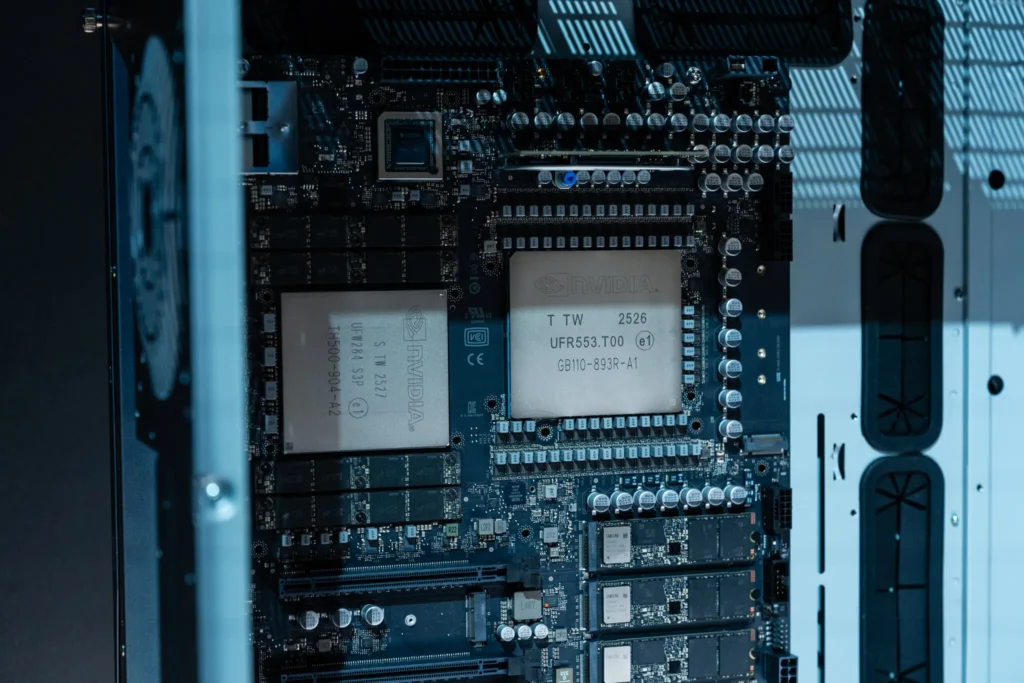

- Nvidia, the leading chipmaker for AI data-centres and training systems, reported blow-out earnings and raised its guidance—validating that demand for AI infrastructure is real and intense.

- Its stock has surged dramatically, helping pull up other tech stocks connected to AI: cloud platforms, memory-chip makers, data-centre equipment providers.

- Analysts now talk of “another wave” of AI adoption: enterprise use-cases, large-language-models, generative-AI services, and expansive cloud deployments—suggesting this is more than just hype.

- The narrative is strong: we’re pre-productivity surge. If AI infrastructure investments pay off, the economic upswing could be massive.

Why the worries won’t fade

- Valuation tension: Many AI-connected stocks trade at extreme valuations, sized for perfect execution and long-term dominance—not just near-term results.

- Infrastructure cost and capital risk: Building AI chips, data-centres, high-power cooling, and global footprint is expensive. If demand slows, these become burdens.

- Execution risk: A big difference exists between “potential” and “realised value”. Many pilots still haven’t produced strong returns.

- Concentration risk: Much of the market’s gains are concentrated in a handful of companies. If one stumbles, the ripple effect could be large.

- Macro-/regulatory risks: Higher interest rates, export controls, supply-chain disruptions, and regulatory scrutiny (for AI safety, privacy, labour impact) all add layers of risk.

Going Beyond the Headlines: What the Conversation Misses

Here are some deeper angles worth exploring:

1. The scale of compute and infrastructure demands

Earnings highlight revenue, but hidden are the mounting costs. Training a large-language model or running massive inference services demands not only cutting-edge GPUs/ASICs, but also vast power, cooling, real-estate and bandwidth. The build-out is industrial in scale. For example, some data-centre expansions are “gigawatt-scale” and cost hundreds of millions annually in energy alone.

This infrastructure commitment transforms an otherwise tech-software business into something closer to manufacturing/infrastructure — with associated risks.

2. Monetisation timing and the business model gap

Investors are betting that AI infrastructure will translate into profits, but often the timeline is uncertain.

- Many companies are still in pilot or proof-of-concept stages.

- The cost base (hardware + software + talent) is already high.

- Returns often lag expectations.

This model mismatch—‘huge upfront cost, uncertain pay-off timeline’—creates a vulnerability: if revenue growth slows, margins compress quickly.

3. Broader market-ecosystem links

Nvidia’s success signals strong demand, but there’s a broader ecosystem: cloud providers buying chips, memory manufacturers ramping production, software platforms building models, enterprises signing multi-year contracts. This creates a web of dependencies.

If any link weakens—say memory chip shortages, or a cloud provider revises its AI capital budget—the ripple can propagate across the ecosystem.

4. The psychology of investor sentiment

Bullish investors believe they are early in a “next-wave” of technology (analogous to the-mobile internet or cloud boom). But that adds risk: the further you are from payoff, the higher your expectations—and the bigger the fall if those expectations disappoint.

In short: upside potential is large and downside risk is heightened.

5. Regulatory, ethical & macro overlays

AI isn’t just business strategy—it’s now part of national strategy, talent policy, supply-chain geopolitics and regulatory oversight:

- Export-controls on advanced chips to certain countries.

- AI safety and ethical frameworks slowly emerging.

- Energy and environmental concerns tied to large data-centres.

- Labour market impacts and shifts in who benefits from AI upgrades.

These add friction and complexity to the “pure growth” narrative.

What This Means for Markets, Companies & Investors

For markets

The AI boom is a major driver of tech stock valuations. But what matters now is not just the headline revenue numbers, but:

- Forward guidance (what companies expect next)

- Utilisation of infrastructure (are expensive assets being used efficiently?)

- Margins (how much of the revenue turns into profit)

- Concentration (are only a few firms benefiting?)

In a way, the market is increasingly pricing in execution rather than just promise.

For companies

- They must balance growth with cost discipline. Infrastructure is expensive; getting the timing right is crucial.

- They should diversify use-cases rather than relying on one big model or one large customer contract.

- They must monitor cash-flow and debt: building big now means you must monetise soon, else risk eruptions.

- They must invest not only in hardware but in software, data, integration and talent—building the full stack.

For investors

- Stay cautious about valuations. High growth expectations are baked in; surprises on the downside can hurt.

- Diversify. If the sector corrects, the most exposed stocks may see sharper drops.

- Monitor fundamentals: not just revenue growth, but capital expenditure, margin trends, guidance updates and sector concentration.

- Be aware of the macro backdrop: interest rates, regulation, global trade tensions all affect valuation multiples.

Frequently Asked Questions

Q1. Is the AI boom just hype?

A: Not entirely. Demand for AI chips and infrastructure is real and growing. But while promise is high, the path from infrastructure to sustained profit is still being proven. So yes: there’s both real substance and real risk.

Q2. Why is Nvidia central to this boom?

A: Because Nvidia dominates the high-end chip market used to train and serve large AI models. Its results act as a proxy for how much companies are willing to invest in AI infrastructure.

Q3. Can the stock gains continue at current pace?

A: They can—if execution is strong, efficiency improves and AI use-cases expand. But the faster the gains, the higher the expectations; any misstep can lead to sharp correction.

Q4. What are the key risks investors should watch?

A: Several: slow monetisation of AI infrastructure, supply-chain problems, regulatory or export-control issues, rising interest rates raising discount rates, valuations running too far ahead of reality.

Q5. What happens if the valuation bubble bursts?

A: If many companies fail to turn infrastructure investment into profits, valuations could compress. That could impact tech indexes, growth stocks and drag on overall market sentiment.

Q6. Should small companies invest heavily in AI now?

A: Only if they understand the cost, know the value-proposition, and plan for returns. Chasing the boom without a clear business case or capital discipline is risky.

Q7. How long until AI delivers broad productivity gains?

A: It may take years. Many enterprises are still implementing pilots. Broad, measurable productivity gains across sectors typically lag the initial hype.

Q8. Are we earlier or later in the AI wave?

A: Many analysts say we’re early—this is still infrastructure build-out and use-case expansion. But some parts of the market are showing signs of maturity and exhaustion of “easy wins”.

Q9. What could be the upside scenario?

A: Wide-scale adoption of AI across industries, dramatic productivity gains, new business models emerging, infrastructure costs falling, and better profit margins—leading to a sustained growth cycle.

Q10. And the worst-case scenario?

A: Infrastructure investments overshoot demand, many use-cases disappoint, valuations collapse, tech sector suffers broad drawdowns, and the AI promise gets delayed by years.

Final Thoughts

The AI boom isn’t just jargon—it’s real, built on massive infrastructure investments, visible earnings growth and broad interest across sectors. But the reason markets can’t shake their worries is also real: the gap between spending and payoff is significant, the stakes are high, and execution risk is front and centre.

If you’re in the arena—whether as a company leader, investor or observer—remember: this is not just a race for growth. It’s a sprint with heavy gear and long turns. How you manage the build, how you time the payoff, and how you guard against unexpected turns will determine whether you ride the next wave—or get caught in the swell.

Sources The New York Times

Rent an affordable luxury party bus in West Palm Beach and make your event extraordinary. With the best prices, professional service, and premium amenities, our buses are perfect for weddings, proms, or any celebration. Celebrate in comfort and style with our elegant West Palm Beach party bus rentals.