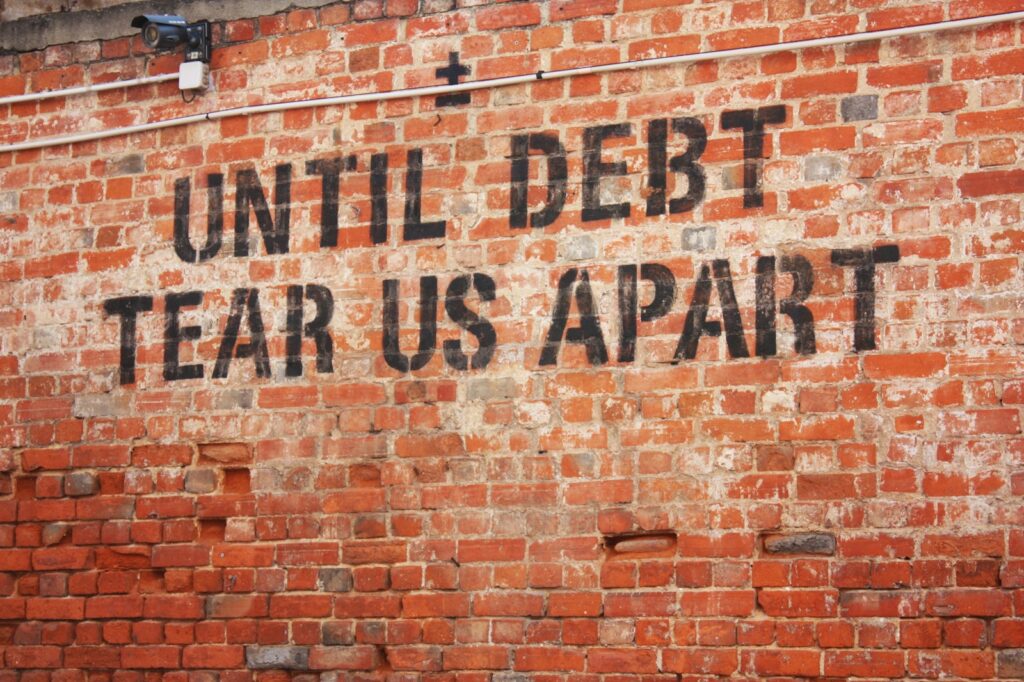

Artificial intelligence has become the most expensive technological bet of the modern era. To stay competitive, the world’s largest technology companies are borrowing at levels once reserved for heavy industry and national infrastructure projects. From record-breaking bond issuances to ballooning balance sheets, Big Tech is taking on unprecedented debt to fund its AI ambitions.

This surge in borrowing is reshaping corporate finance, investor expectations, and even global economic risk. The story is not just about AI hype—it’s about how far companies are willing to stretch themselves to avoid falling behind.

Why Big Tech Is Borrowing So Much for AI

Building and deploying advanced AI systems is extraordinarily capital-intensive. The biggest costs include:

- Massive data centers

- Specialized AI chips and hardware

- Energy infrastructure and long-term power contracts

- Talent acquisition and retention

- Research, training, and deployment at scale

Unlike earlier software booms, AI requires physical infrastructure on an industrial scale. Even companies with enormous cash reserves are turning to debt markets to move faster.

Debt as a Strategic Weapon in the AI Race

For Big Tech firms, borrowing isn’t just about financing—it’s about positioning.

Taking on debt allows companies to:

- Lock in long-term funding before interest rates rise further

- Scale AI infrastructure faster than rivals

- Signal confidence and dominance to investors

- Absorb short-term losses in pursuit of long-term control

In an AI arms race, speed matters more than balance-sheet conservatism.

How This Wave of Debt Differs From the Past

Historically, tech companies avoided heavy debt, relying instead on cash flow and equity. AI has changed that norm.

Key differences include:

- Debt funding core strategy, not acquisitions alone

- Longer repayment timelines tied to uncertain AI returns

- Greater exposure to interest rate fluctuations

- Heavier reliance on future productivity gains

This makes today’s tech debt more speculative than previous borrowing cycles.

Investor Confidence—and Anxiety

So far, markets have largely tolerated the borrowing spree. Investors believe that:

- AI will unlock major productivity gains

- Big Tech can monetize AI at scale

- Dominant firms can absorb debt shocks

But skepticism is growing.

Concerns include:

- Unclear timelines for AI profitability

- Rising energy and operating costs

- Potential overcapacity in data centers

- The risk of an AI investment bubble

If returns lag expectations, debt could quickly become a liability.

The Energy and Infrastructure Factor

One overlooked driver of AI debt is energy.

AI data centers require:

- Vast amounts of electricity

- Reliable, long-term power supply

- Water for cooling

- Grid upgrades and new generation

These costs resemble utilities or manufacturing—not traditional tech. As a result, companies are financing AI like infrastructure projects, often with decades-long horizons.

What This Means for Competition

Heavy borrowing raises the barriers to entry.

Smaller firms and startups:

- Can’t match the scale of investment

- Become dependent on Big Tech platforms

- Risk being squeezed out of foundational AI layers

This accelerates consolidation and concentrates AI power among a few debt-backed giants.

What the Original Coverage Often Misses

Debt Locks In Strategic Direction

Once billions are spent on data centers and chips, pivoting becomes difficult.

Public Risk, Private Reward

If AI investments fail, broader markets may absorb the shock.

AI Monetization Is Still Uncertain

Many AI services remain subsidized or bundled, not profitable on their own.

Timing Matters

Debt taken on today assumes AI value arrives soon—not in a distant future.

Could This Create a Tech Debt Crisis?

A crisis isn’t inevitable—but risks are rising.

Potential triggers include:

- Slower-than-expected AI adoption

- Regulatory limits on AI use

- Energy shortages or cost spikes

- Economic downturns reducing enterprise spending

Big Tech can carry debt—but not indefinitely without returns.

Why Companies Feel They Have No Choice

Despite the risks, executives see borrowing as unavoidable.

In AI, standing still means falling behind. And falling behind may mean irrelevance.

The logic is simple:

It’s better to take on debt and win—than stay cautious and lose.

Frequently Asked Questions

Why don’t tech companies just use their cash reserves?

AI spending is so large and ongoing that even massive cash piles aren’t enough to fund rapid expansion alone.

Is this level of debt dangerous for Big Tech?

Not immediately, but it increases vulnerability if AI returns disappoint.

Are investors worried?

Some are. Confidence remains high, but patience is not unlimited.

Could AI fail to justify the spending?

Yes. Monetization models are still evolving, and outcomes are uncertain.

Does this hurt innovation?

It may reduce competition by favoring only the largest players.

Is this similar to past tech bubbles?

In scale, yes—but this boom is more infrastructure-heavy and harder to unwind.

The Bottom Line

Big Tech’s record-breaking debt binge reveals how serious—and how risky—the AI race has become.

Artificial intelligence is no longer just a software upgrade. It’s an infrastructure gamble measured in tens of billions of dollars. Companies are betting that AI will transform productivity, markets, and society fast enough to justify the borrowing.

If they’re right, today’s debt will look visionary.

If they’re wrong, the cost won’t just hit balance sheets—it could ripple across the global economy.

The future of AI may be built on intelligence.

But right now, it’s being built on debt.

Sources The Washington Post