A new era of artificial intelligence (AI) is in full throttle—and the numbers are staggering. Investment commitments, infrastructure builds and business bets in AI are measured in hundreds of billions, soon to reach trillions of dollars globally. Yet beneath all that momentum lies a contradiction: while firms and nations forecast massive returns and transformative impact, many of the tools, business models and regulatory frameworks remain immature. The race is on—but the finish line is vague.

What’s fueling the race

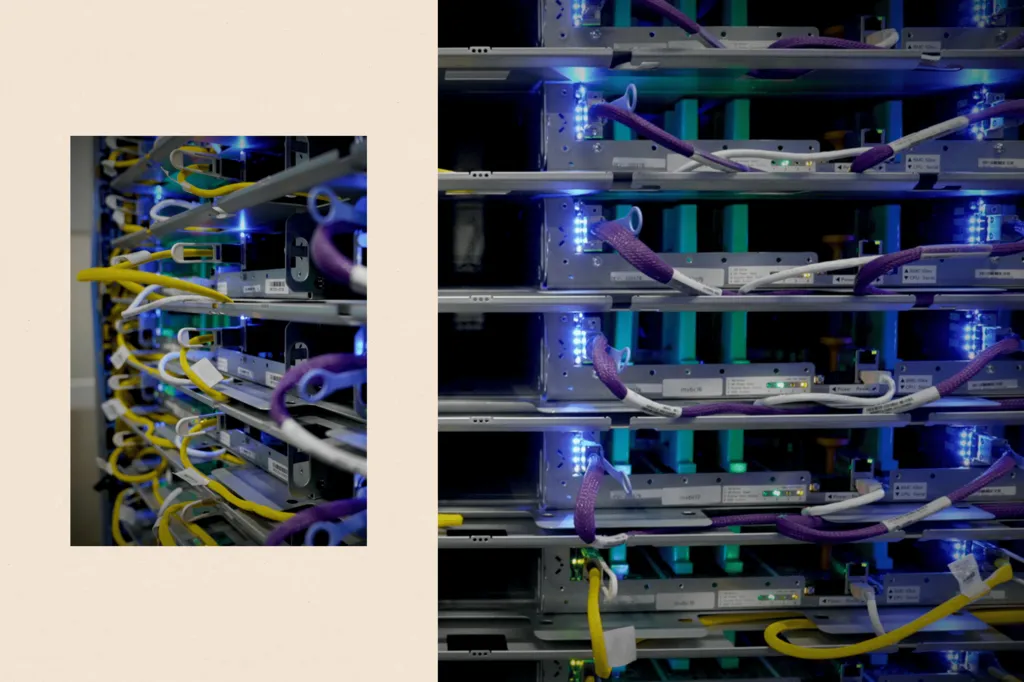

- Major tech companies and nation states are pouring capital into data-centres, specialised chips, cloud infrastructure and foundational models (large-language models, multimodal systems).

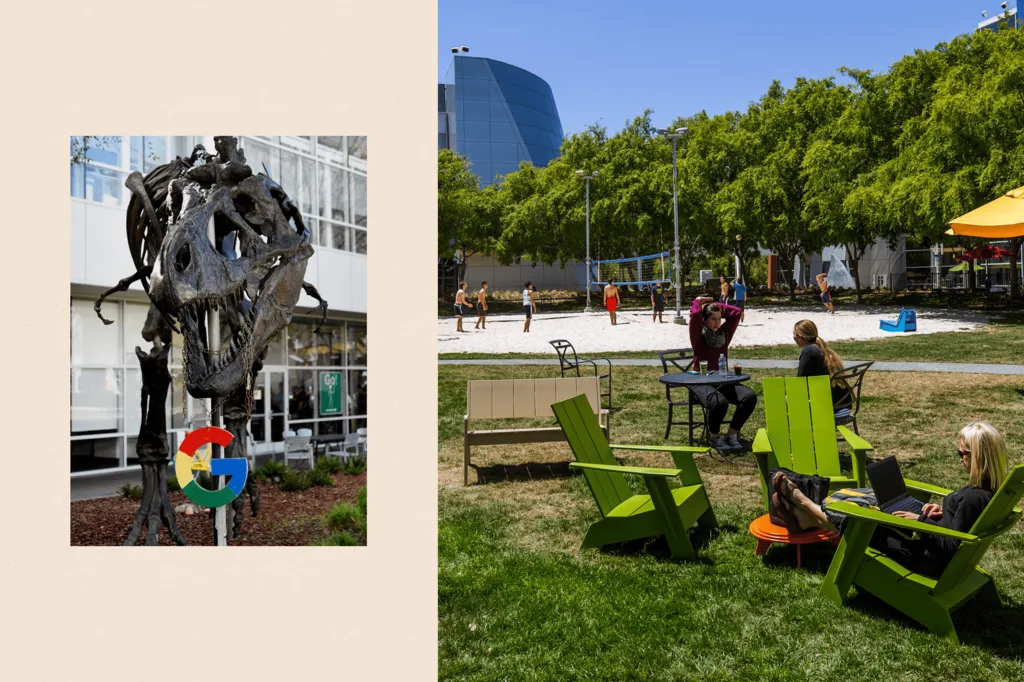

- Because AI is seen as the next frontier of technology and economic growth, there is a strong push to secure dominance—first mover advantage, ecosystem control, data lock-in and global influence.

- The investment isn’t just software any more: it’s hardware, rare earths, real estate, power infrastructure, and global supply chains. As a result, the scale and capital intensity of AI builds rival that of major industrial sectors.

- At the same time, hype is running high—expectations of business transformation, productivity surge, creative disruption and societal change are baked into investor and executive discourse.

The contradiction

Here’s where the paradox shows up:

- Massive infrastructure bets, uncertain returns. The investments are huge—but many business use-cases remain nascent; many deployments are still experimental; many models still struggle with reliability, cost-efficiency or ethical/social issues.

- Hype meets bottlenecks. The idea of “AI everywhere” is promoted, yet the real bottlenecks are physical: power, cooling, chips, data, talent and energy. These constraints may slow what looks like unstoppable momentum.

- Open rhetoric, closed reality. Companies say AI is democratizing and transformative for all, yet the most advanced tools, infrastructure and profit-centres remain concentrated in a handful of firms and countries. This centralisation raises questions about whether the benefits will truly spread.

- Competition and collaboration collide. Nations and companies race to dominate AI, yet all depend on global supply chains, shared research, international talent. The more closed the race becomes, the more friction and inefficiency may emerge.

What the Original Story Covered

The BBC article highlighted:

- The size and speed of the AI investment cycle, and how that creates systemic risk (a “bubble-like” dynamic).

- The infrastructure demands of AI (chips, racks, power) exceeding what many expected.

- The disconnect between the promise of AI and some of the practical limitations.

- The geopolitical dimensions of the race—how countries are positioning AI as strategic.

What the Discussion Missed—or Needs More Emphasis

Let’s dig deeper, exploring aspects that deserve further attention:

1. The compute and energy bottleneck

While many talk about models and software, less visible is how much energy, cooling and data-centre real-estate big AI actually consumes.

- Reports suggest that large models may require gigawatt-scale infrastructure and incur electricity costs running into tens or hundreds of millions annually.

- Some local grids are stressed by new data-centre builds; regulatory push-back (NIMBYism) is increasing over land/energy use.

- The assumption of “scale it up and it works” is challenged by margins: increasing size of models doesn’t always equate to proportional gains in performance.

2. Business-model clarity and monetisation risk

- Many AI investment announcements promise “transforming industries” but fewer demonstrate sustainable monetisation.

- Analysts warn of circular financing: companies invest in each other’s commitments (e.g., chip maker promises to buy cloud, cloud promises to buy compute) which may inflate valuations without immediate underlying profitability.

- If adoption lags, or costs remain high, the capital intensity may erode returns.

3. Talent, supply chain & geopolitical risk

- Leading AI labs depend on global talent (researchers, engineers), and risk arises from restrictions on migration, export controls and national security concerns.

- Supply chains for specialised chips (GPUs, TPUs), packaging, cooling, rare minerals are global and exposed to disruption.

- Dominance in AI is increasingly a system-of-systems race (compute + data + models + real-world deployment), not just algorithmic. Countries that lag in one leg may fall behind.

4. Societal and regulatory mismatch

- The societal implications—privacy, bias, job disruption, security threats—are rising, yet regulation and governance frameworks are still catching up.

- If infrastructure-heavy models drive concentration of power in a few firms, the promise of wide-benefit may fail.

- There is tension: race faster vs regulate carefully. If nations push too fast without guardrails, risks (safety, ethical, environmental) increase.

5. What happens if expectations aren’t met?

- Past tech booms show that when infrastructure build-out overshoots demand (railways, telecoms, dot-com), many investments become stranded assets.

- If the AI ROI cycle lengthens, investor patience may fade, valuations may compress, and momentum could stall.

- The sheer scale of build-out that is happening now means the potential upside is large—but so is the downside if things go off track.

Where Things Might Go (Three Scenarios)

Scenario A – Productive Build-Out

AI infrastructure, compute and models scale, real business cases (healthcare, energy, science, enterprise) start to deliver strong returns, regulatory frameworks mature, competition spreads more evenly. The big investments pay off, and society benefits broadly.

Scenario B – Over-Investment & Consolidation

Infrastructure build-out races ahead of monetisation. Many investments under-perform. Only large-scale firms survive. Smaller players are squeezed. Market resets (some firms fail), and the long-term structure consolidates into a few dominant players.

Scenario C – Plateau & Diversify

AI still advances, but the returns on ever-larger models and infrastructure diminish. Companies shift to smaller, smarter models, edge computing, localisation. The arms-race of trillions cools, and the “big model” paradigm gives way to efficient, specialised AI. Infrastructure growth continues but at a slower pace.

Why This Matters for Everyone

- For investors: The scale of spending means huge opportunities—but also big risks. Timing, valuations, capital discipline and adoption matter more than ever.

- For businesses: Choosing the right AI investments, aligning infrastructure with real-world use-cases, and avoiding hype traps will determine winners.

- For policymakers: Ensuring safety, fairness, competition and environmental sustainability in the AI build-out matters for public interest. Regulation can’t lag far behind.

- For society: Whether the benefits of AI (productivity, innovation, new services) are widely shared—or captured by a few—depends partly on how this race unfolds. The contradiction between promise and infrastructure shows the outcome is far from guaranteed.

Frequently Asked Questions

Q1. Why is the AI race described as “trillion-dollar”?

A: Because investments, infrastructure commitments, build-outs and model training costs across multiple major firms and countries are measured in hundreds of billions—and aggregated across industry could pass the trillion-dollar mark in the coming years.

Q2. What is the core contradiction in the AI race?

A: On the one hand, there is promise of rapid transformation, broad adoption and massive return. On the other hand, the infrastructure, costs, bottlenecks and business models are still uneven and unproven. The race is underway even though key fundamentals (cost-efficiency, regulation, societal readiness) are not yet resolved.

Q3. Are we in a bubble?

A: Some observers believe so—or at least caution that expectations are extremely high and many investments may not generate near-term returns. Others say that even if some spending is excessive, the long-term payoff of AI merits the build-out. The truth likely lies in between.

Q4. What are the biggest bottlenecks?

A: Compute hardware and chips, data-centre real-estate and energy, talent acquisition, supply-chain constraints, business-case adoption (how to monetise), regulatory and ethical frameworks, and ensuring real use-cases deliver value.

Q5. Who stands to benefit and who might lose?

A: Large tech firms and early-mover nations stand to benefit if they execute well. Firms or countries unable to scale infrastructure, attract talent or monetise may be left behind. Society at large may lose if benefits are concentrated and costs (energy, environmental, inequality) mount.

Q6. What happens if this infrastructure is built but returns are slow?

A: Risks include stranded assets (under-utilised data centres or chips), compressed valuations, slower adoption, market correction, and consolidation—where only a few players remain dominant.

Q7. Can smaller firms still succeed?

A: Yes—but they may need to focus on efficiency, specialised niches, edge computing, partnering instead of building everything themselves. The “big build everything” model may favour large incumbents.

Q8. What should governments do?

A: They should invest in core infrastructure (power, talent, connectivity), regulate for safety and fairness, support innovation and competition, ensure global collaboration while guarding national interest, and avoid blindly following a race mindset without review of cost, benefit and risk.

Q9. How does this affect consumers?

A: Potentially huge gains: smarter services, new products, lower cost AI-enabled tools. But also risks: increased concentration of power, less competition, privacy concerns, environmental cost. Consumers will benefit most if deployment is broad and equitable.

Q10. Is this the end of AI hype or just the start?

A: It’s likely just the start—but a more mature phase. The early hype (e.g., chatbots) is being replaced with infrastructure build-out and enterprise deployment. The next decade may be less about “wow” demos and more about performance, efficiency, return on investment, regulation and societal integration.

Final Thoughts

The trillion-dollar AI race is not simply about being first—it’s about building the right foundations, managing scale, ensuring value, and addressing the hidden costs. The contradiction at its heart reminds us: even as the world charges forward, many of the pieces are still being placed.

How this next chapter plays out will depend on who builds smarter, who spends wiser, who integrates faster—and who remembers that infrastructure is only as valuable as what it enables. Stay tuned; the high-stakes game has only just begun.

Sources BBC